Share This Post

Maximize Food Savings with Simple Meal Planning

Years ago, I started wondering why we worked so hard and never had enough money at the end of the month. I tracked our spending for 1 month and was shocked to discover we’d spent $800 on groceries and $1200 eating out. All while we were throwing food out because it expired before we could eat it. Similar to the notion that if you don’t tell your money where to go (i.e., spending plan), it disappears, if you don’t make a meal plan each week, your hard-earned money is likely being thrown away in the form of spoiled food.

If you have worked with me, we have put together a plan that lays out how much you’re comfortable spending on food each month. Food is usually the #2 highest expense in my client’s budgets when we first meet, at $1,969/mth for an average family of 3. If that sounds like a lot, it is as compared to the national average of ~$835 for a family of 3. Even with consistently rising food prices, there are plenty of ways to reduce food expenses. After working with me and implementing some of the tips below, my average client cuts their food expenditures by 39%.

Top tip: Meal Planning [Now, stick with me!] Meal-Planning is not glamourous, but it’s also not as challenging as you may think. You don’t need any fancy templates for this – just pen and paper. First things first… go shopping in that deep-freezer and pantry of yours. Write down everything you have (i.e., chicken breasts = 3 packages, etc), then use this as a guide for what else you need to buy once you pick out your recipes. Building your recipe list around what you already have on hand can save big $$$.

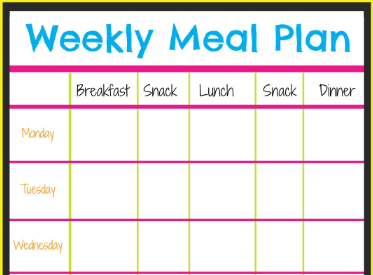

Before picking out your recipes, you’ll need to consider how many meals you’ll need. The goal is to not purchase more than is needed. Most people envision writing down what will be consumed at every single meal – breakfast, lunch, and dinner. I’ve only ever disappointed myself with this approach. I get too tired to make food or I’m not craving the thing I wrote down and I opt to eat out, which defeats the whole purpose of a meal plan. Instead, try counting the number of (human 🙃) heads in your household that eat and the number of meals you’ll eat across a week (e.g., 3 meals a day for 2 people across 7 days = 42). Make sure your final number is reduced to include the number of meals you plan to eat out that week.

I tend to choose recipes with 4-6 servings (because who wants leftovers over and over?), which would equate to needing 7-11 recipes, assuming my family will not eat out that week. Plenty of websites offer the ability to search recipes based on the ingredients you have on hand; I prefer Skinny Taste because a) I have yet to try a recipe I don’t like and b) they make it easy to specify dietary restrictions like dairy intolerance ✋.

If your kids’ activity schedule keeps you super busy or you simply don’t enjoy being in the kitchen, aim for recipes that take less than 30 minutes but that your family will actually eat. This takes some introspection and honesty with self. ‘Sunday Katie’ has been known to have great intentions for selecting meals that ‘Wednesday Katie’ would just assume throw out the window and order takeout instead. Keep in mind that selecting recipes is a time investment, but with practice, I’ve reduced my process to ~20 minutes a week.

Once you’ve selected your recipes, build your grocery list. Write everything down and take this to the store with you. The keys to success are sticking to the list and shopping only once a week. Every time you enter a grocery store; it’s an opportunity to find things you didn’t know you “needed”. While on the topic of grocery stores, consider the true cost of grocery delivery services. From 15-20% standard price markups to service fees to tipping… not to mention someone picking out food that is either spoiled or near spoiled. There is a price to pay for convenience. Is it worth it to you as it relates to your financial goals?

For those like me who don’t particularly enjoy being in the kitchen, but can appreciate the valuable cost-savings, choose something to look forward to while cooking. Pour yourself a glass of wine. Blast Chappell Roan’s latest album. Have the family join in. Eat dessert first. Be proud of yourself for getting this far. Pour those good intentions into the meal you’re making – it’ll taste better. Really!

Other habits that will help reduce food expenditures:

- Keep ready-made, enjoyable food on hand for lazy/busy nights

- Whenever you use the last of something, add it to your grocery list for the following week.

- Ask partner or kids to assist you with cooking and clean-up

- Keep snacks on hand to reduce the need for last-minute eating out

- Consider picking one day a week to do all of your meal prep, then organizing and/or freezing your meals so they’re on hand whenever you need them

- Consider a cash budget for food. If cash runs out before month-end, get creative with the food you have in storage.

As with any new habit, these will take time, patience, and intention to implement. Don’t let inevitable, occasional failures derail you from reaching your financial goals.